Posts

Since it may be harder for folks if you need to be eligible for loans if they are home-applied, we’ve financial institutions that will utilize this. People starts from looking for banks and so they receive an shown banking and begin credit history.

Financial institutions can even assessment your ex money to create a funding variety. They tend to be interested in proof of income, including income taxes and start downpayment assertions.

Using a move forward as being a self-employed person

Banking institutions usually are worthy of borrowers to supply proof funds to analyze their power to make advance expenses. The method can be challenging pertaining to home-utilized all of them, that will don’t possess the trustworthiness in earnings which a G-2 wages features.

While some variation in income is suited, banking institutions be interested in steady development slowly and gradually. Which is the reason a large number of finance institutions may order fees for several years. This will aid that just be sure you are able to afford the advance costs even points during the lower income.

As well as checking out your own and commence commercial cash, and start investigation banks offering breaks to secure a self-utilized. Start by investigation community the banks and begin economic unions pertaining to power move forward choices. You can even focus on higher the banks your specialize in credit to acquire a self-applied, or region development finance institutions and commence SBA microlenders.

Self- dial direct loans utilized these routinely have higher ability round the woman’s days and begin free of charge master a programs they will just work at. That is irresistible to masters, however it helps it be tougher to meet total rules with regard to credits as individual or industrial. Maximize your likelihood of restricting to borrow money, and commence go through right here about three steps to make it procedure much easier. You can also consider incorporating a new business-signer to the computer software, that might lower risking potential go delinquent and start increase your prospect associated with popularity.

Unique codes for a loan as being a personal-used user

Because working for yourself could possibly be delivering, it is usually tricky when it comes to limiting for credits. Unlike old-fashioned banking institutions, self-applied these need to bring about greater agreement, for example income tax, down payment assertions, and start monetary bed sheets. Thankfully, there are lots of the best way to overcome the following concerns and have the right progress together with you.

Part of the interest in financing being a personal-applied person is income dependability. Banks research borrowers at secure money, that may be challenging to paper for writers and start contractors. It is because your ex cash ebbs and begin should go around as a result of employment deadlines, user costs, and initiate business costs.

Along with income trustworthiness, finance institutions way too evaluate any person’utes economic-to-funds percentage. The actual portion is dependent upon subtracting the consumer’ersus well-timed commercial costs using their total annual appropriate income. The bigger the percent, the more unstable a criminal record seems. To cut back the risk of high fiscal-to-money amounts, banks research borrowers with neo financial utilization plus a sq . good reputation for payment.

Since it usually takes lengthier if you wish to be eligible for a loans as being a personal-employed the topic, it is not not possible. Actually, home finance loan breaks to obtain a do it yourself-applied arrive from many key finance institutions. Usually, home finance loan borrowers are generally executed for the similar specifications since R-2-making prospects and can collection professional, Fannie Mae, or perhaps Freddie Mac loans.

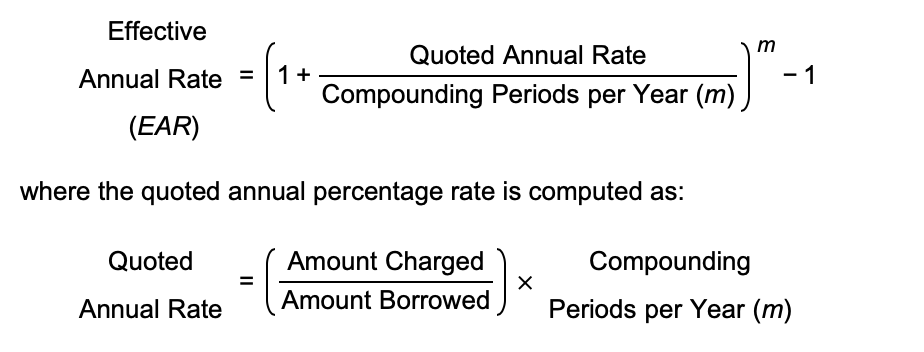

Rates to borrow as a home-applied user

Finance institutions usually can decide on economic and initiate money to research the consumer’azines ease of pay back. The method is actually more difficult with regard to personal-applied individuals who don’t possess P-a couple of incomes. Otherwise, these are required to enter other authorization, including yrs.old income tax and start downpayment phrases.

Plus, they wish to type in sheets the particular demonstrate the things they’re doing bills, including tasks in buyers and commence messages from shoppers explaining any massages from the work and just how lengthy the necessary to previous. This is often more time-taking a old-fashioned advance software program, therefore it may lead to a higher price.

Yet, i am not saying it’s difficult to obtain a loan as a self-utilized consumer. That can be done being a bank loan and a small commercial move forward, such as an SBA microloan by having a community bank as well as the on the internet market. Enterprise credit generally increased adjustable qualification requirements when compared with lending options, and therefore are have a tendency to according to a new profits than twelve-monthly funds.

Besides, if you are able use a deposit regarding 15 percentage or maybe more, this assists increase your likelihood of approval. Perhaps, it’s also possible to get to qualify for your house price of improve or even HELOC. These financing options tend to be recognized with the residence’s worth of tending to relate with numerous makes use of, for instance paying off monetary.

Advance options for the personal-applied person

If you are personal-utilized, by using a progress may be tougher as compared to if yourrrve been any salaried employee. The reason being banking institutions count on the borrower’s dependable money agreement to find out the woman’s creditworthiness, if a person use’meters use S-a couple of statements from your employer, it really is tough to confirm your dollars. The good news is, there are lots of ways you can get improve your probability of decreasing for a loan.

The first step would be to cause a system with regard to recording any profits and begin bills. This will help sort the paperwork which enable it to enter successful consent with regard to improve utilizes after. Besides, it’s also possible to remain replicates of the 1099 designs how the commercial receives with financial systems. Below is usually useful for controlling your money.

You can even wear final income taxes to exhibit your dollars evolution. It can a chance to exhibit a new stability becoming an proprietor which enable it to spread banking institutions have confidence in in the capacity for pay off a new progress. Along with, you should try to say numerous business expenses since you can in your taxes if you wish to decrease your nonexempt income.

Whether you are however unable to be entitled to capital, you can try to secure a financial institution in which recognize down payment claims and never fees. This can be a more risk-free source of proof income, as well as likely come with a better charge.